Have you ever wanted or considered investing in Austin’s real estate market? With a booming population and the crazy growth Austin has been experiencing over the last decade it has become a hot destination for real estate investors to park their cash. 51.3% of Austin, Texas residents rent their homes meaning the majority of the population is filling rental properties owned by investors across the nation and even the world. This has made Austin’s rental property investment market a competitive one where investors are competing for great deals on property. Now more than ever you need to make sure the deal makes financial sense and below we go over 3 numbers that need to be evaluated before you buy a rental property in Austin, Texas.

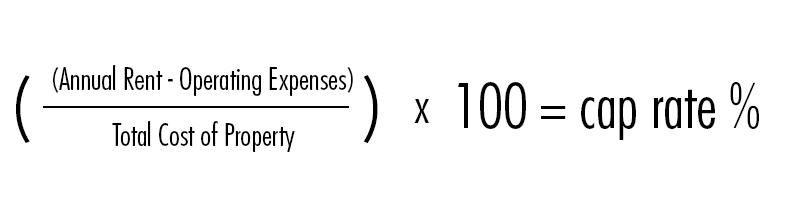

Capitalization Rate

Capitalization Rate, or cap rate, is the rate of return that should be expected on your investment. The cap rate can be used to quickly compare to deals you may be looking at and can be calculated by subtracting annual expenses from the annual rent and dividing that number by the total cost of the property. You’d then multiply that number by 100 to receive a percentage. If you calculated the cap rate and found out your investment’s cap rate is about 20% you should expect to have your initial investment back from the property after 5 years.

Mortgage Payment

When purchasing a home that you plan on living in you have access to loans, such as FHA, that can get you in a property for as little as 3.5% down. When purchasing a rental property, most lenders will require you to put down a 15-20% down payment. To qualify for the lower 15% would require you to have a credit score above 720. In the event you are looking to acquire a multi-family property, you are looking at a down payment closer to 25%. Another thing to consider is your debt-to-income ratio. When purchasing a rental property, most lenders say the maximum debt-to-income ratio you want to have is 45%. What happens when you experience a slow period where no one is renting this property? Do you have the means to and cash on hand to cover any expenses and the mortgage during this time? Like any investment, there is always risk involved and minimizing your risk is key.

The Property’s Cash Flow

In the end, you want your rental property to be an asset, not a liability. If you can cover the operating costs of your rental property with the monthly rent you are in great shape as a landlord. Of course, any unexpected speed bumps with your property, such as repairs or unexpected vacancies, can have you dipping into your own pockets for cash to cover your property’s expenses. Be wary of how much money you borrow on your investment property. Borrowing too much can put you in a hole where your property runs a negative cash flow and you could end up defaulting on your loan.

While these numbers are important to factor into your decision when buying rental property in Austin they aren’t the only things you need to consider before pulling the trigger on your purchase. Due diligence is an important step of any investment acquisition so be sure to run the numbers once, twice and even a third time to make sure you know exactly what you are getting into.

Now that you understand what you're looking for in regards to your real estate investment, you still need to find the home. What areas of Austin, Texas are best for buying rental properties? Learn about the best areas of Austin, Texas to purchase a rental home from the perspective of an Austin property manager.

Want to discuss acquiring properties with a team that's been in the Austin rental market for over a decade? Contact our Austin property management team today to speak with an investment real estate specialist.

Another number to keep in mind is how much your property is going to earn in rent! We'd be happy to show you just how much your property can earn and how much other properties in your neighborhood are earning. Click the image below to claim your free market analysis from a property manager at Stone Oak!

For questions about Austin property management services please don't hesitate to contact our team at Stone Oak Property Management.