Every single year, Tax time rolls around and every homeowner, investor, etc that owns a property in Austin, Texas must pay their property taxes.

Did you know you can do yourself a big favor and try and reduce the amount you owe? It can be done by protesting your property taxes with the county!

We’d like to provide a comprehensive overview of the tax protest and will cover the following items in this post:

Property Taxes Explained

Tax Values and Rates

Reasons for protesting

Property Tax Timeline

Tax Exemptions

Property Tax Math

Paying Your Tax Bill

Texas Property Taxes Explained

Texas property owners pay billions of dollars a year in property taxes. Texas does not have a state income tax so property taxes support local government services like police, fire departments and schools.

The amount of property taxes you pay is determined by two numbers:

Home Value x Rate = Total Property Tax Due

Both your property’s market value and tax rates are set by local authorities. Tax rates can be changed every year but any large increases have to be voter-approved. The value of your property is set by the county appraiser and can be challenged by filing a protest. The primary driver of property values in Texas is the real estate market, which tends to rise in value over time.

The County’s Appraisal Process

Texas law requires your property to be appraised at market value as of January 1st by the county assessor. The market value is the price at which the property would transfer on the open market. County appraisers are required to reappraise all properties at least once every three years, but some do it every year. Most county appraisal offices use a mass appraisal approach, which rely on a standard appraisal methodology and real estate market data to come up with a market value. The counties must abide by the Uniform Standards of Professional Appraisal Practice if a mass appraisal is used. These mass appraisals are imperfect and often lead to incorrect values being assigned to many properties.

There are two main methods for appraising residential properties:

The sales argument compares your home to other homes in your area that sold last year. When the real estate market is hot, the sales argument is often not very helpful.

The equity argument compares your home to the county’s value for ALL other homes in your area, not just the ones that sold. When the county values your home in an unequal manner, the error can be fixed which reduces your market value and often your taxes due.

Every data point that the county uses for a given property must be adjusted to make it comparable to other, similar properties. There are 30-40 different data points that are used to compare residential properties. Cosmetic improvements, landscaping, and HVAC issues are not included in the tax valuation of a property.

For commercial properties counties often use a third approach…income. This valuation approach uses income and expense data to determine the value of the property. It aims to determine what an investor would pay for a property based on its anticipated revenue stream.

Understanding Texas Property Values

Each residential property has ten different values and they are all correct! Each value is calculated differently and used for a different purpose. The two most important property values for property taxes are your tax-appraised value and tax-assessed value. The tax appraised value (also called your market value) is what the county thinks your home is worth. The tax-assessed value is the value you pay taxes on and is influenced by your property tax exemptions. If an appraised value is higher than the assessed value, that means your exemptions are helping you pay less tax.

By law, protesting focuses on lowering the appraised (or market) value, not the assessed value. But in most cases, when you lower your appraised value you will also see a corresponding reduction in your assessed value. The only exception is when the real estate market is hot, hot, hot and your value has increased by more than any exemption caps you have been approved for.

Texas Tax Rates

Tax rates, set by local taxing entities, play a significant role in calculating the amount of taxes each property owner owes. Taxing entities like schools, police, and fire departments, create a budget and adopt a property tax rate to support that budget.

Each taxing entity is required, by law, to generate the same amount of revenue from the previous year if the same rate was applied to the same amount of properties. This means that tax rates can fluctuate up or down each year depending on the total market value of properties in the jurisdiction.

When increasing the tax rate, taxing units need to get voter approval for the following increases:

If the increase for cities and counties is over 3.5%

If the increase for Hospitals, special tax units, and junior college districts operating expenses is over 8%

School district funding calculations and the debt tax rate influence the voter-approval tax rate for school districts.

The Texas Property Tax Transparency website is a great resource to learn about future public hearings, proposed budgets and tax rates, and additional information.

Why Should You Protest?

Below are some reasons why property owners in Austin should want to protest their property taxes every single year:

Avoid Being Overtaxed

Protesting is the only way to make sure you are not being overtaxed for your property in Austin. More than likely you already pay enough in taxes, without protesting that number can just keep rising every single year.

Don’t give up more money than you need to do for your property by protesting the taxes.

You Save Money

The act of protesting your taxes lets you find errors in the calculations and factors used to determine the amount of money you owe in property taxes. By finding these errors, property owners can save big money on their property come tax time.

Help the Neighborhood

Funny enough, if your entire neighborhood protested their taxes you’d be throwing block parties every tax season.

Protesting helps your neighbors by keeping tax values in check across your neighborhood. If any home in your neighborhood is overvalued on their property taxes it hurts everyone in the neighborhood. Be the change you want to see in your neighborhood!

You’ve Got Nothing to Lose

Protesting your property taxes in Austin comes with zero risk. By law, the county cannot raise the tax amount owed on your property during a protest!

With our partner at Stone Oak Property Management, you pay no upfront costs to work with Home Tax Shield and you only pay a portion of the savings on your tax bill should they be able to successfully protest your taxes. It’s a win-win!

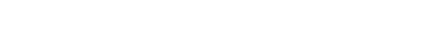

Property Tax Timeline and When to Take Action on Your Property

When it comes to property taxes, you don’t ever want to miss a deadline! Below is a summary of important dates for property owners in Austin, Texas to know:

Above you’ll see a timeline given by our partner, Home Tax Shield, and the steps taken by their service to save property owners money. Working with Home Tax Shield can help save you money and time and is fully endorsed by our staff here at Stone Oak Property Management.

Property Tax Exemptions in Austin, Texas

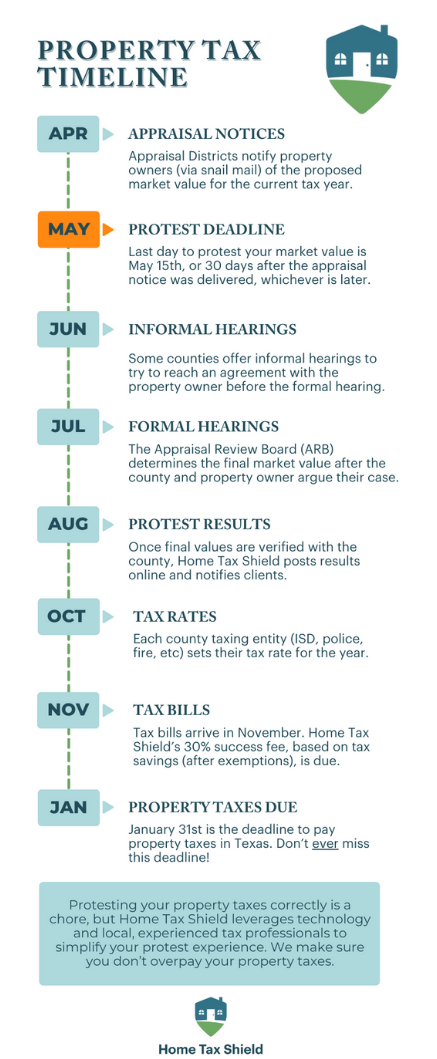

Homestead Exemption

Filing for a homestead exemption can save you thousands on your property taxes each year in Austin, Texas. Below you see an infographic provided by Home Tax Shield explaining the homestead exemption.

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence.

If you fall under this umbrella be sure to contact Home Tax Shield if you need assistance with getting this exemption applied to your property taxes.

The Over-65 Exemption

If you are 65+ in age you can apply for the Over 65 exemption on your property taxes. What this does is freeze the school taxes that you owe on your property. See the infographic below for more info:

Other exemptions do exist and can be applied to your property as well. These include:

Disabled Person Exemption

Disabled Veteran Exemption

Inherited Residence Exemption

Surviving Spouse of First Responders Killed in the Line of Duty Exemption

Agricultural and Timber Exemptions

Solar and Wind-Powered Energy Device Exemptions

Temporary Disaster Exemptions

Charitable Organizations and Business Exemptions

For more information about these exemptions and if they apply to you visit Home Tax Shield with any questions you might have.

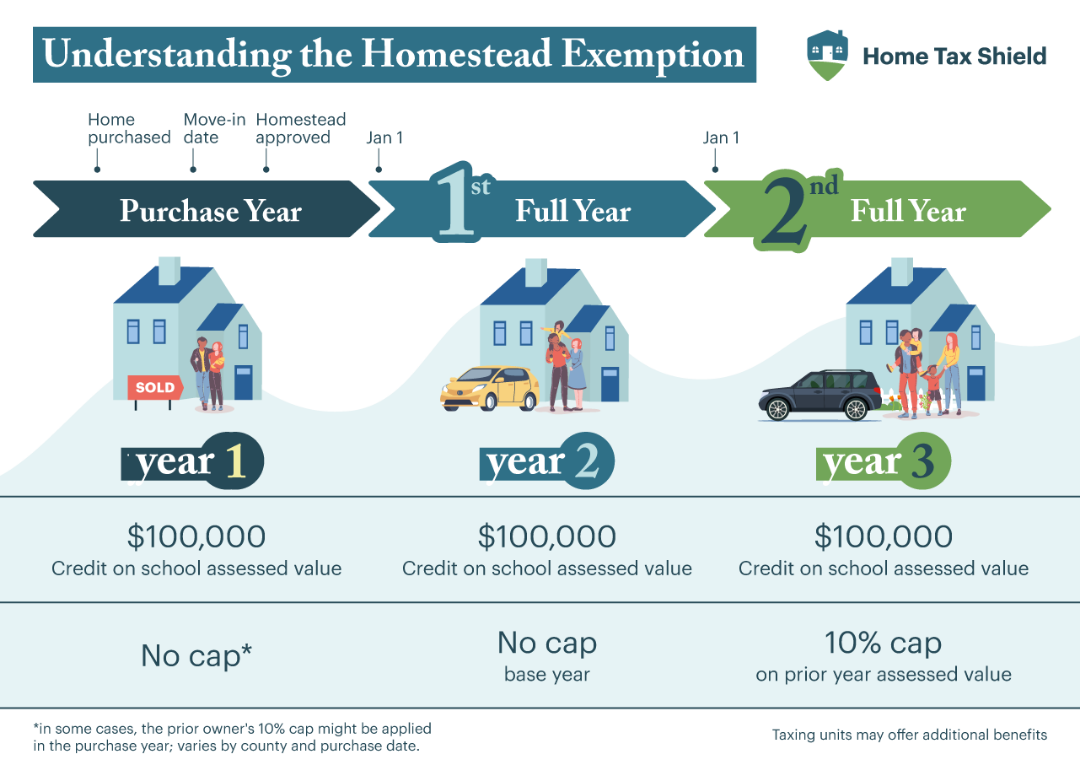

The Math Behind Your Property Taxes

As we saw above, exemptions are there to save you money at tax time! Exemptions work in one of two ways. They can either exempt a portion of the value from being taxed, or they can cap how property taxes can increase on your home year-over-year.

As an example, in the infographic below you can how the homestead exemption can save property owners money at tax time if applied correctly to their bill from the county.

Above is an example of how it works when protesting your taxes and applying the homestead exemption and what your final bill could come out looking like. You can see from the example above that they were able to drastically reduce the assessed value of their home and significantly lower the bill they have due come tax time!

Paying Your Property Tax Bill

Tax bills are mailed each November/December and are due by January 31st of the following year. Each tax bill will use the property value, tax rates and any exemptions on the property to calculate the total property tax owed for the calendar year.

If you are a homeowner who elected to allow your mortgage company to pay your property taxes via an escrow account, your mortgage company will pay the property taxes. Any shortage or excess will be rolled into your future monthly mortgage payments. Additionally, each year your mortgage company estimates the amount of property tax needed to pay your next property tax bill. When your mortgage company estimates your taxes to rise next year, your mortgage payment will go up, and vice versa.

So what type of final results can you expect when working with a company like Home Tax Shield to protest your property taxes?

Everyone’s situations are different and the exemptions you qualify for will defer from other people. On average, property owners who protest their taxes with Home Tax Shield see a $30,000+ average value reduction from their home, making their final bill come tax time lower than taking no action when it comes to protesting the property taxes on your home.

It is a win-win for everyone involved! Our team at Stone Oak Property Management fully endorses the use of services like Home Tax Shield and believes it provides a great benefit to anyone who owns a property in Texas. We have several members of our team who do so on their own personal properties here in Austin and we suggest you take advantage of this too!

Get started with Home Tax Shield and protest your property taxes this year!